The mobile phone market is more competitive than ever. This article delves into how rival brands and industry strategies shape both market trends and consumer perceptions. Discover key players, emerging technologies, and the forces driving growth in today’s fast-evolving mobile industry.

By Newswriters Editorial Desk

The global mobile phone market is a textbook example of an oligopoly, a market structure dominated by a small number of large, interdependent firms. This nature of competition shapes every aspect of the industry, from innovation and pricing to marketing and consumer choice.

The market is overwhelmingly led by a handful of giants, primarily Apple and Samsung, with other significant players like Xiaomi, OPPO, and vivo comprising the core competitive set. These firms hold substantial market share and influence, creating high barriers to entry for new competitors due to the immense costs associated with research and development, supply chain control, and global marketing.

Competition within this oligopoly is fierce but manifests in non-price strategies more than outright price wars. The key battlegrounds are:

Product Differentiation and Innovation: The primary competitive tool is continuous innovation. Rivalry focuses on technological one-upmanship: superior camera systems, more powerful processors, foldable screens, and exclusive software ecosystems (iOS vs. Android). This creates a cycle of planned obsolescence, encouraging frequent upgrades.

Brand Loyalty and Ecosystem Lock-in: Companies invest billions in building brand identity and creating interconnected ecosystems of devices and services (e.g., Apple’s iCloud, App Store, and Watch). This strategy increases switching costs for consumers, cementing loyalty and creating a recurring revenue stream beyond the initial handset sale.

Marketing and Perception: With products often having overlapping features, colossal marketing budgets are deployed to shape consumer perception and create a distinct brand image, associating devices with lifestyle, prestige, or specific values.

While the saturated high-end segment is an oligopolistic playground, the market also features monopolistic competition in lower tiers. Here, numerous smaller brands compete on slight variations in features, design, and price, but they lack the market power to challenge the leaders globally.

Technological advancement but also leads to high consumer prices and a competitive landscape where a few titans constantly jockey for position through innovation, brand power, and ecosystem dominance, rather than through significant price reductions.

The Indian Market

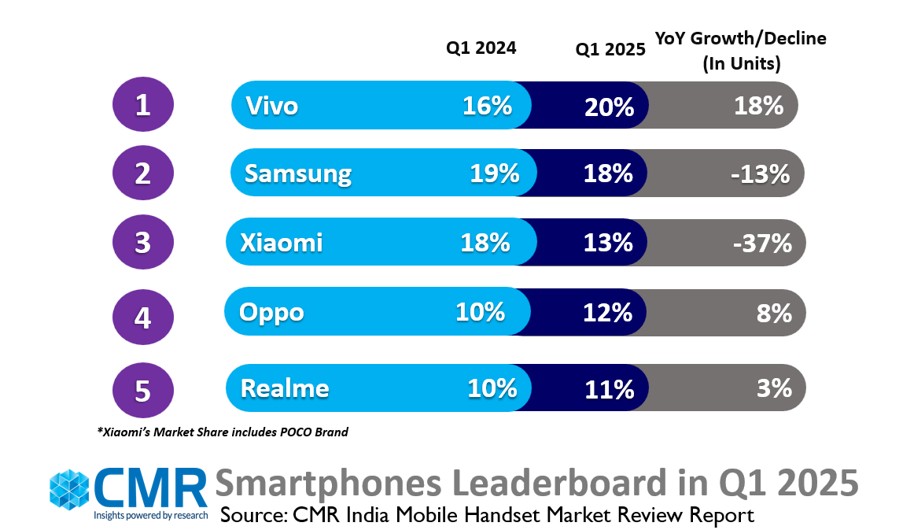

The Indian mobile market presents a fascinating and distinct competitive landscape within the global oligopoly. While global leaders like Samsung and Apple maintain a strong presence, the market is characterized by a fierce battle for volume in the budget and mid-range segments. This has been historically dominated by Chinese manufacturers like Xiaomi, Realme, and OPPO/vivo, which achieved massive success by offering feature-rich devices at aggressive price points.

However, this dynamic is currently being reshaped by the rapid resurgence of Indian corporations and a government push for local manufacturing. The rise of domestic players like Micromax and Lava in the past, and more recently, the JioPhone series targeting the entry-level segment, adds a unique layer of nationalist and price-sensitive competition not as prevalent in Western markets.

This unique structure creates a multi-tiered competitive environment. At the premium end, Apple and Samsung compete on brand prestige and cutting-edge technology, largely insulated from the price wars below. In the volume-driven mass market, however, competition is intensely price-sensitive and fragmented.

Brands compete on razor-thin margins, often customizing features like battery capacity and camera specifications specifically for Indian consumers. Furthermore, government policies like the Production Linked Incentive (PLI) scheme act as a significant non-market force, incentivizing all major players to manufacture locally and influencing their cost structures and strategic planning. This makes the Indian arena a complex blend of global oligopoly power and hyper-local, value-focused monopolistic competition.