Oxfam says the world’s super-rich are nearly 4,000 times more likely to wield political power than the average citizen and now control all major social media platforms, according to a report released ahead of the World Economic Forum’s annual meeting in Davos.

Billionaire wealth surged to unprecedented levels in 2025, according to a new Oxfam report released ahead of the World Economic Forum at Davos, even as billions worldwide grapple with poverty, hunger, and economic insecurity. With the richest individuals accumulating trillions in a single year and wielding growing political influence, the report has reignited a contentious global debate: are higher taxes enough, or is expropriation of extreme wealth becoming a serious policy question in an era of deepening inequality?

By Newswriters News Desk

In 2025, the world’s richest individuals saw their fortunes swell at a pace that even seasoned inequality analysts describe as unprecedented. According to Oxfam’s latest global inequality report, billionaire wealth jumped roughly 16 % in a single year to a record $18.3 trillion, a growth rate about three times faster than the average of the past five years. That surge represents an 81 % increase in collective billionaire wealth since 2020 — even as poverty and hunger persist for billions of people.

The Oxfam report, released ahead of the World Economic Forum’s annual Davos meeting, frames this accumulation of private fortunes not as an incidental outcome of global markets, but as a symptom of deeply unequal economic and political systems — in which wealth begets influence and influence begets more wealth.

The Numbers Tell a Stark Story

In concrete terms, the data are staggering. Global billionaire wealth now exceeds $18 trillion — more than the economies of most nations. Oxfam highlights that the $2.5 trillion added to billionaire wealth in 2025 is roughly equal to the total wealth of the poorest 4.1 billion people on Earth combined. Meanwhile, one in four people struggle to eat regularly, and almost half the world lives in poverty, according to Oxfam’s analysis.

Notably, the number of individuals classified as billionaires has also crossed the 3,000 mark for the first time. Within that cohort, the top dozen wealth holders — many associated with major tech platforms, financial institutions, and media empires — collectively control more wealth than the poorest half of humanity.

Power and Politics: A Rising Oligarchy?

US President Donald Trump and Elon Musk during the Division I Men’s Wrestling Championship held at Wells Fargo Center, Philadelphia, Pennsylvania [File: Eric Hartline. Images/Reuters]

Beyond mere numbers, Oxfam’s report underscores a more troubling trend: the intertwining of economic power with political and social influence. Billionaires are now estimated to be about 4,000 times more likely to hold political office than the average person. This concentration of political power, the report argues, gives the ultra-wealthy outsized influence in shaping policies that affect taxation, regulation, labor rights, climate action, and democratic governance itself.

The result, according to critics, is not merely entrenched inequality but a systemic distortion of democratic processes — what some scholars call “elite capture,” where policy serves the interests of the few rather than the many. This dynamic has been documented in tax-policy debates in multiple regions, where corporate and billionaire interests have successfully lobbied for lower tax rates, loopholes, and incentives that disproportionately benefit capital over labor.

From Reporting to Radical Remedies: Why Some Call for Expropriation

In light of these trends, a growing chorus of economists, labor activists, and social justice advocates is pushing debate beyond reform-oriented solutions like progressive taxes or wealth levies. They are now making the case for expropriation — the forcible transfer of private wealth or assets to public ownership — arguing that incremental reforms have failed to curb the relentless rise of concentrated wealth and power.

What Expropriation Advocates Argue

Supporters of expropriation frame it as a corrective measure to rebalance economic power and fund public goods that global markets currently undersupply:

1. Wealth as Socially Produced

They assert that much of billionaire wealth is not a result of individual genius alone but collective social investment — public infrastructure, educated workforces, state-funded research, and legal systems that underpin markets. From this perspective, extreme private fortunes are “unearned windfalls” that should be subject to public claim.

2. Democracy and Accountability

Given that political influence now correlates with wealth, critics of existing systems argue that private control over vast economic resources undermines democratic sovereignty. Expropriation is presented not just as redistributive justice but as a means of reasserting democratic control over economically powerful actors.

3. Funding Public Goods

The sheer scale of billionaire wealth suggests, to advocates of expropriation, an opportunity to address pressing global crises. Theoretically, reallocating a fraction of extreme private wealth could finance universal healthcare, climate mitigation, education, and poverty eradication — objectives that current public budgets, constrained by tax competition and austerity, struggle to meet. Indeed, Oxfam itself notes that billionaire wealth could eliminate extreme poverty many times over if deployed differently.

Forms of Expropriation Under Discussion

The term “expropriation” covers a wide range of proposals, from one-time wealth taxes and asset seizures to long-term social ownership of strategic sectors such as finance, energy, and digital infrastructure. Some advocate for “progressive socialization” measures that would democratize corporate governance and return dividends to the public. Others propose targeted expropriation of assets tied to natural monopolies or unearned rents. Each variant raises distinct legal, economic, and ethical questions.

Criticisms and Challenges

Despite growing support among some circles, expropriation remains controversial and faces substantial opposition:

1. Legal and Constitutional Barriers

In many democracies, private property rights are protected by constitutions and international trade agreements. Forced seizure or large-scale redistribution of wealth would likely trigger protracted legal battles and could undermine investor confidence.

2. Economic Disruption

Critics warn that expropriation — especially if perceived as arbitrary — could trigger capital flight, reduce investment, or slow economic growth. The fear is that punitive measures risk destabilizing financial markets already sensitive to policy uncertainty.

3. Political Backlash and Polarization

Expropriation proposals risk deepening political polarization. Opponents characterize them as extremist or anti-market, potentially mobilizing well-funded resistance from elite interest groups.

Beyond Expropriation: Broader Policy Debates

Even among those who reject forced expropriation, the Oxfam report has galvanized debate on how to rein in runaway wealth inequality. Commonly discussed policy alternatives include:

- Progressive wealth taxes, calibrated to minimize capital flight but reduce concentration at the top.

- Tax reforms closing loopholes and curbing avoidance strategies that allow the ultra-rich to pay lower effective rates than middle-income earners.

- Public investment in social protections and universal services to offset inequality’s social costs.

- Campaign finance and lobbying reforms to reduce the political power of concentrated wealth.

Oxfam itself promotes heavier taxation on extreme wealth and stronger rules to limit money’s influence in politics — less radical than expropriation but still contentious in policy circles.

Conclusion: A Tipping Point in the Inequality Debate

The 2025 Oxfam report underscores a widening chasm between the ultra-wealthy and the rest of society — not just economically, but politically and socially. In framing billionaire wealth accumulation as a “danger to democracy,” the report has intensified global discussions on inequality, justice, and the future of capitalism.

While expropriation remains on the fringe of mainstream policy, its increasing presence in public discourse reflects deep frustration with the persistence of extreme inequality. Whether via wealth taxes, regulatory overhaul, or more radical redistributive measures, societies face pressing questions about how to balance personal wealth and collective welfare in the 21st century.

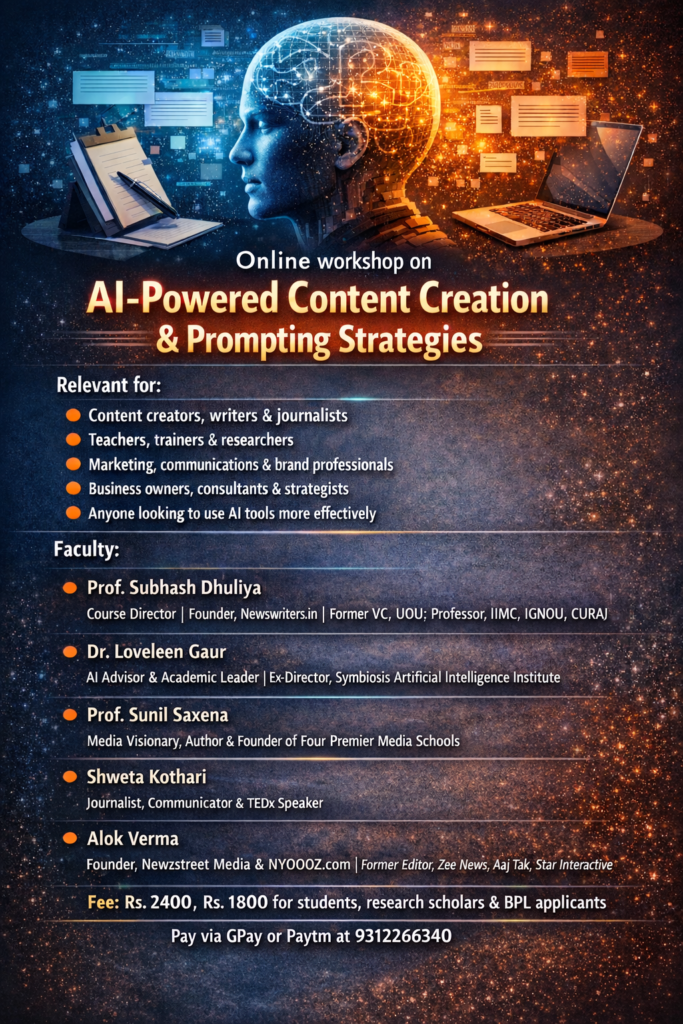

PROMOTIONAL CONTENT